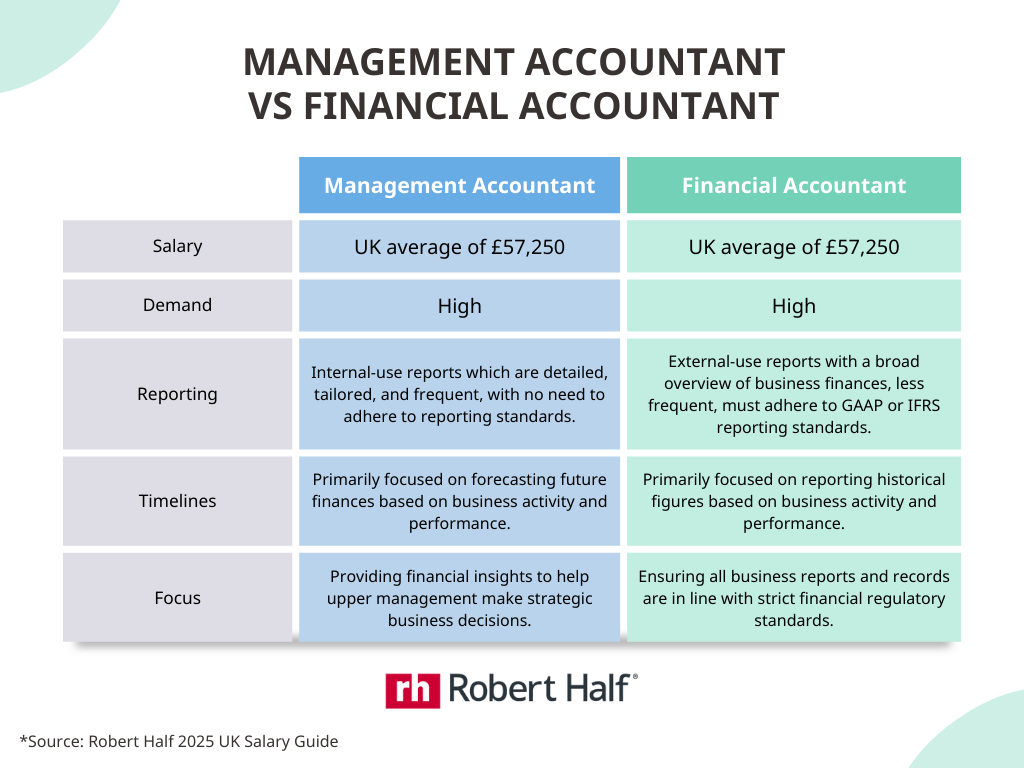

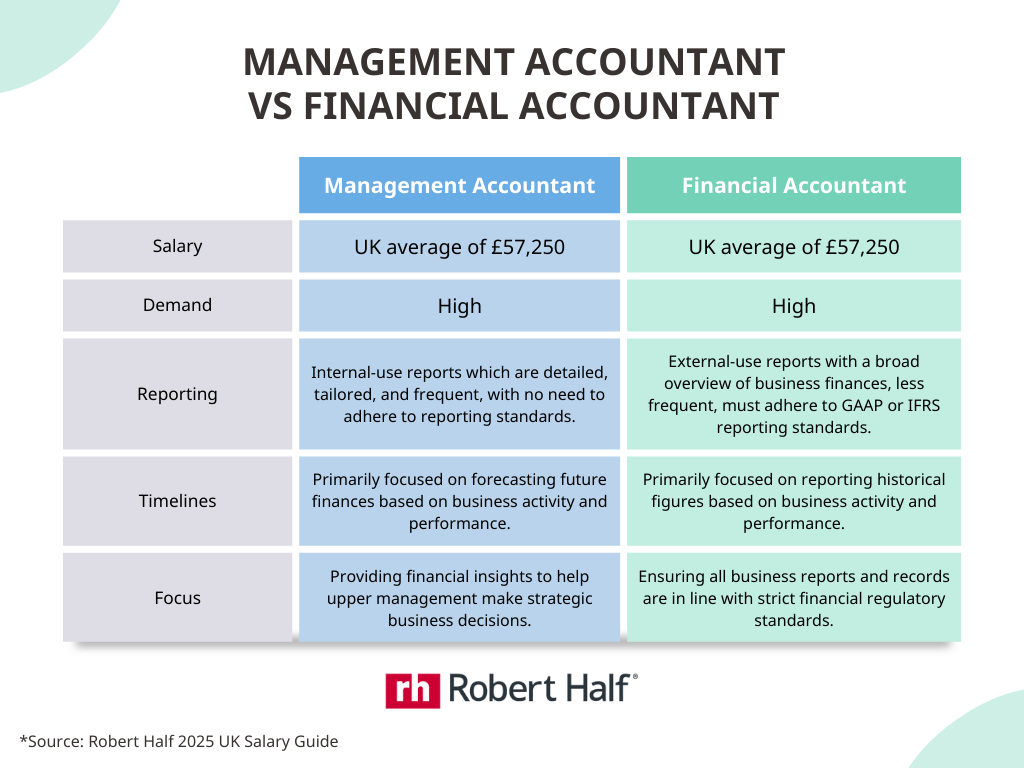

The financial reports generated by accounting serve different purposes depending on the audience.

Financial accounting provides a standardised set of statements for external users, while management accounting creates a wider variety of reports specifically designed to meet the needs of internal decision-makers.

Financial accounting culminates in three core financial statements:

Income statement: This statement summarises a company's revenue and expenses over a specific period, ultimately revealing the net income or loss. It provides a clear picture of the company's profitability.

Balance sheet: This statement offers a snapshot of the company's financial position at a specific point in time. It shows what the company owns (assets), owes (liabilities), and the difference, which represents shareholder equity.

Cash flow statement: This statement details the cash inflows and outflows of the company over a period, categorised into operating, investing, and financing activities.

These standardised statements are crucial for external users like investors and creditors to assess a company's financial health, performance, and risk. The consistent format allows for easy comparison between UK or global companies within the same industry.

Management accounting reports are not limited to a standardised format. Instead, they are customised to address specific managerial concerns and decision-making needs. Some key examples of management accounting reports include:

Cost-Volume-Profit (CVP) analysis: This report helps managers understand the relationship between costs, sales volume, and profit. It allows them to forecast the impact of changes in sales volume or pricing on profitability.

Budgeting: Budgets are detailed financial plans outlining future income and expenses. They help managers set goals, allocate resources effectively, and track progress towards those goals.

Variance analysis: This report compares actual results with budgeted figures, identifying any significant deviations. Variance analysis helps managers pinpoint areas where costs might be exceeding expectations or revenue might be falling short, allowing for corrective action.

These are just a few examples, and the specific reports generated by management accounting will vary depending on the nature and size of the business.

The key takeaway is that management accounting reports provide a deeper dive into the company's financial performance, offering insights that go beyond the basic information presented in financial statements.

This tailored information empowers managers to make informed decisions that can improve operational efficiency, profitability, and overall business performance.

The financial information a company presents holds significant weight, impacting investment decisions, lending opportunities, and public perception. To ensure the accuracy and reliability of this information, financial accounting operates within a stricter regulatory framework compared to management accounting.

Financial statements prepared by a company undergo external audits by independent accounting firms. These audits are crucial for maintaining public trust in the financial reporting process. Auditors meticulously examine the company's financial records and accounting practices to ensure compliance with established accounting standards, such as GAAP or IFRS.

Any discrepancies or deviations from these standards must be disclosed and explained in the financial statements. This external scrutiny serves as a safeguard against fraudulent reporting or manipulation of financial data.

The difference with management accounting reports is that they are not subject to the same level of external oversight. Since they are intended for internal use by managers, there is no requirement for independent audits.

However, this doesn't mean management accounting operates in a free-for-all environment. Companies still need to maintain strong internal controls to ensure the accuracy and reliability of the data used in these reports.